The banking sector in America is a vital component of the nation’s financial infrastructure, providing individuals and businesses with essential financial services. With numerous options available, choosing the right bank can significantly impact your financial experience.

In this article, we’ll explore the top 10 banks in America, considering factors such as accessibility, account options, fees, customer service, and more. Whether you’re looking for a bank to open your first account or seeking to switch to a better option, this comprehensive guide will help you make an informed decision.

Factors to Consider When Choosing a Bank

Before diving into the top 10 banks, it’s crucial to understand the key factors you should consider when selecting a bank that aligns with your needs:

Accessibility and Branch Network

Having a wide-reaching branch network ensures that you can easily access your bank, make deposits, and seek assistance when needed. Some banks have a vast physical presence, while others primarily operate online or through limited brick-and-mortar branches.

Online Banking and Mobile App Features

In today’s digital age, online banking and mobile apps play a significant role in managing your finances. Look for banks that offer user-friendly, feature-rich online platforms, allowing you to perform tasks like fund transfers, bill payments, and mobile check deposits.

Account Types and Fees

Different banks offer various account types, each catering to different customer needs. Consider the fees associated with each account, including monthly maintenance fees, overdraft charges, and ATM fees.

Interest Rates and APY

Interest rates and annual percentage yield (APY) impact the growth of your savings over time. Banks may offer different rates for savings accounts, certificates of deposit (CDs), and money market accounts.

Customer Service and Support

Good customer service is essential for a positive banking experience. Check reviews and ratings to assess the bank’s responsiveness and overall customer satisfaction.

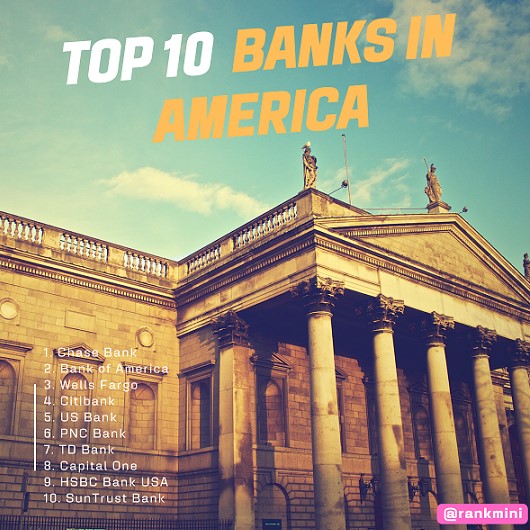

The Top 10 Banks in America

Now that we have a foundation for making an informed choice let’s explore the top 10 banks in America:

1. Chase Bank

Chase Bank, a subsidiary of JPMorgan Chase & Co., is one of the largest and most well-established banks in America. With a history dating back over 200 years, Chase offers a wide range of financial services to millions of customers across the country.

Account Options and Benefits: Chase provides various account options, including checking accounts, savings accounts, CDs, and retirement accounts. Each account comes with its own set of benefits and features tailored to different customer needs.

Online Banking and Mobile App Features: Chase’s online banking platform and mobile app are user-friendly, allowing customers to manage their accounts, pay bills, and deposit checks using their smartphones.

Branch Network and Accessibility: Chase boasts an extensive branch network, making it convenient for customers to access in-person services in various locations.

Customer Reviews and Satisfaction: Chase has generally received positive customer reviews, praised for its robust customer service and innovative digital banking features.

2. Bank of America

As one of the largest and oldest banks in America, Bank of America holds a prominent position in the financial industry, serving millions of customers with a wide array of banking products.

Account Options and Benefits: Bank of America offers a diverse selection of accounts, including checking accounts, savings accounts, CDs, IRAs, and more, each tailored to meet specific financial goals.

Online Banking and Mobile App Features: Bank of America’s online banking platform and mobile app provide users with a seamless and secure banking experience, allowing them to carry out transactions, track expenses, and set financial goals.

Branch Network and Accessibility: Bank of America has a substantial physical presence with branches and ATMs spread across the country, providing customers with easy access to in-person services.

Customer Reviews and Satisfaction: The bank has received mixed reviews, with some customers praising its technological advancements while others have expressed concerns about fees.

3. Wells Fargo

Wells Fargo is another prominent player in the American banking industry, offering an extensive range of financial products and services.

Account Options and Benefits: Wells Fargo provides a variety of account options, including checking and savings accounts, CDs, and specialized accounts for students and retirees.

Online Banking and Mobile App Features: Wells Fargo’s online banking platform and mobile app offer a comprehensive suite of features, enabling customers to manage their finances with ease.

Branch Network and Accessibility: Wells Fargo has a widespread branch and ATM network, making it accessible for customers across the nation.

Customer Reviews and Satisfaction: While Wells Fargo has faced some controversies in the past, the bank has continued to serve millions of satisfied customers, earning positive reviews for its services.

4. Citibank

Citibank, a subsidiary of Citigroup, is a global banking giant with a substantial presence in America.

Account Options and Benefits: Citibank offers various account options, including checking accounts, savings accounts, money market accounts, and investment accounts.

Online Banking and Mobile App Features: Citibank’s online banking platform and mobile app provide users with a seamless and secure banking experience, offering features like budgeting tools and account alerts.

Branch Network and Accessibility: Citibank has a strong branch presence in major cities, ensuring customers have easy access to physical banking services.

Customer Reviews and Satisfaction: The bank has received mixed customer reviews, with some praising its international banking capabilities, while others have raised concerns about fees.

5. US Bank

US Bank is one of the largest banks in America, offering a broad range of financial products and services.

Account Options and Benefits: US Bank provides a variety of account options, including checking and savings accounts, CDs, and retirement accounts, each tailored to meet different customer needs.

Online Banking and Mobile App Features: US Bank’s online banking platform and mobile app offer a user-friendly experience, allowing customers to manage their finances conveniently.

Branch Network and Accessibility: US Bank has an extensive branch network, providing customers with multiple locations for in-person banking services.

Customer Reviews and Satisfaction: US Bank has garnered positive customer reviews for its customer service and efficient online banking features.

6. PNC Bank

PNC Bank is a regional bank with a significant presence in the eastern and midwestern United States.

Account Options and Benefits: PNC Bank offers various account options, including checking accounts, savings accounts, CDs, and specialized accounts for students and young savers.

Online Banking and Mobile App Features: PNC Bank’s online banking platform and mobile app offer a range of features, including mobile check deposits and budgeting tools.

Branch Network and Accessibility: PNC Bank has a strong branch network, predominantly serving customers in the eastern and midwestern states.

Customer Reviews and Satisfaction: PNC Bank has received positive reviews, with customers appreciating its competitive rates and user-friendly online banking interface.

7. TD Bank

TD Bank, a subsidiary of the Toronto-Dominion Bank, is a well-known and established bank in America, particularly along the east coast.

Account Options and Benefits: TD Bank offers various account options, including checking accounts, savings accounts, CDs, and IRAs.

Online Banking and Mobile App Features: TD Bank’s online banking platform and mobile app are lauded for their user-friendly design and features like online bill payment and account alerts.

Branch Network and Accessibility: TD Bank has a strong presence along the east coast, providing customers with convenient access to physical banking services.

Customer Reviews and Satisfaction: TD Bank has garnered positive customer reviews for its friendly staff, extended branch hours, and easy-to-use mobile app.

8. Capital One

Capital One is a renowned bank known for its credit card offerings and diverse banking products.

Account Options and Benefits: Capital One offers various account options, including checking and savings accounts, CDs, and IRAs, along with its well-regarded credit card options.

Online Banking and Mobile App Features: Capital One’s online banking platform and mobile app are user-friendly, enabling customers to manage their finances with ease.

Branch Network and Accessibility: While Capital One has a more limited branch network compared to traditional banks, it compensates with strong online and mobile banking capabilities.

Customer Reviews and Satisfaction: Capital One has received positive customer reviews, especially for its credit card rewards program and online banking features.

9. HSBC Bank USA

HSBC Bank USA, a subsidiary of HSBC Holdings plc, is a global bank with a considerable presence in the United States.

Account Options and Benefits: HSBC Bank USA offers various account options, including checking accounts, savings accounts, CDs, and premier banking for high net worth individuals.

Online Banking and Mobile App Features: HSBC Bank USA’s online banking platform and mobile app provide customers with a secure and convenient banking experience.

Branch Network and Accessibility: While HSBC Bank USA has a more limited branch network, it compensates with strong online and mobile banking capabilities.

Customer Reviews and Satisfaction: HSBC Bank USA has garnered mixed reviews, with some customers praising its international banking services and others mentioning certain customer service issues.

10. SunTrust Bank

SunTrust Bank, now part of Truist Financial Corporation, operates primarily in the southeastern United States.

Account Options and Benefits: SunTrust Bank offers various account options, including checking and savings accounts, CDs, and specialized accounts for students and retirees.

Online Banking and Mobile App Features: SunTrust Bank’s online banking platform and mobile app provide customers with a seamless banking experience, including mobile check deposit and bill pay.

Branch Network and Accessibility: SunTrust Bank has a strong branch network, mainly serving customers in the southeastern states.

Customer Reviews and Satisfaction: SunTrust Bank has received positive reviews for its customer service and personalized banking experience.

Comparison and Ranking

Now that we’ve explored the top 10 banks, it’s essential to compare them based on various factors and rank them accordingly:

Factors Contributing to the Rankings

The ranking of these banks is determined by considering factors such as the size of the bank, customer satisfaction, accessibility, online banking features, fees, and interest rates.

Comparative Analysis of the Top 10 Banks

- Size and Reach: Chase Bank, Bank of America, and Wells Fargo are among the largest banks, offering extensive branch networks and services across the nation.

- Online Banking: Capital One and TD Bank stand out for their exceptional online banking and mobile app features, providing seamless digital banking experiences.

- Fees and Interest Rates: US Bank and Citibank offer competitive fees and attractive interest rates on savings accounts.

- Customer Service: PNC Bank and SunTrust Bank receive praise for their customer service, providing personalized experiences for their clients.

Unique Features and Differentiators

Each of the top 10 banks has unique features and offerings that cater to different customer needs. For example:

- Chase Bank excels in rewards and credit card offerings.

- Bank of America offers a wide range of mortgage and home loan options.

- Wells Fargo provides specialized financial planning and wealth management services.

- Citibank stands out for its global presence and international banking services.

- US Bank focuses on community engagement and corporate social responsibility initiatives.

- PNC Bank prioritizes student and young saver accounts to encourage financial literacy.

- TD Bank has extended branch hours and weekend banking for customer convenience.

- Capital One is renowned for its credit card rewards and cashback programs.

- HSBC Bank USA specializes in international banking and foreign currency services.

- SunTrust Bank offers tailored banking solutions for medical professionals and business owners.

How to Open an Account with any of These Top Banks

Opening an account with a top bank is a straightforward process:

1. Gather Necessary Documents and Requirements

To open an account, you’ll typically need a government-issued ID, proof of address, and your Social Security number.

2. Step-by-Step Account Opening Process

Visit the bank’s website or a nearby branch to start the account opening process. Choose the account type that suits your needs, provide the required information, and make an initial deposit.

3. Tips for a Smooth Account Setup

- Research the account options and benefits to find the one that aligns with your financial goals.

- Take advantage of any promotions or bonuses offered by the bank for new account holders.

- Consider setting up direct deposit to streamline your finances and earn potential rewards.

Conclusion

Choosing the right bank is a crucial decision that can significantly impact your financial well-being. The top 10 banks in America, including Chase Bank, Bank of America, Wells Fargo, Citibank, US Bank, PNC Bank, TD Bank, Capital One, HSBC Bank USA, and SunTrust Bank, each offer a unique set of features and benefits. Whether you prioritize accessibility, online banking capabilities, low fees, or personalized service, there’s a bank on this list that can cater to your needs. Take the time to research and compare these options to make an informed decision that best aligns with your financial objectives.

FAQs

How were these banks selected as the top 10 in America? These banks were selected based on their size, customer satisfaction, branch network, online banking features, fees, and interest rates. Extensive research and analysis were conducted to curate this list.

Are there any local banks that could be better options? Local banks can be excellent alternatives for customers who prioritize personalized service and community involvement. However, the top 10 banks in America offer nationwide accessibility and a broader range of financial products.

Can I open an account with these banks if I’m not a U.S. citizen? Most of the top banks on this list allow non-U.S. citizens to open accounts, but specific requirements may vary. You may need to provide additional documentation to comply with regulatory guidelines.

What is the minimum deposit required to open an account? The minimum deposit required to open an account varies depending on the bank and the type of account you choose. Some banks offer no minimum deposit options for specific account types.

How do I find the nearest branch of these banks? You can locate the nearest branch of these banks by visiting their official websites and using their branch locator tools or mobile apps.

Are there any hidden fees I should be aware of? While banks strive to be transparent about their fees, it’s essential to review the fee schedule carefully before opening an account to avoid any surprises.

Can I link multiple accounts under the same bank? Yes, most banks allow customers to link multiple accounts under the same bank, making it easier to manage finances in one place.

How long does it take to open an account? The account opening process can vary depending on the bank and the type of account. In some cases, you may be able to open an account online within minutes, while others may require a visit to a branch.

What is the typical interest rate for savings accounts? Interest rates for savings accounts fluctuate with market conditions and are subject to change. It’s best to check with the specific bank for the most up-to-date rates.

How secure is online banking with these banks? Top banks prioritize the security of their online banking platforms, employing encryption and multi-factor authentication to protect customer data.

Can I open an account for my business? Yes, many of these banks offer business banking services, including business checking accounts, savings accounts, and business loans.

What should I do if I lose my debit card? If you lose your debit card, promptly contact your bank’s customer service or use their mobile app to report the lost card and request a replacement.

Do these banks offer rewards or cashback programs? Yes, several of these banks offer rewards and cashback programs, particularly on credit cards and certain account types. Check with the bank for specific offers.

Are there any age restrictions for account holders? While some banks offer specialized accounts for minors, many of the account options on this list are available to individuals of all ages.

What are the penalties for overdrawing my account? Overdraft fees and penalties can vary among banks. It’s essential to be aware of the bank’s policies regarding overdrafts to avoid unexpected charges.

Can I open an account jointly with another person? Yes, most banks allow customers to open joint accounts with another individual, such as a spouse or family member.

Are there any additional benefits for long-time customers? Some banks offer loyalty programs or preferential treatment for long-time customers, including higher interest rates or fee waivers.

How can I contact customer support if I have an issue? You can typically contact customer support through phone, email, or live chat on the bank’s website or mobile app.

Is there a limit on the number of transactions per month? Some accounts have transaction limits, particularly for savings accounts. Exceeding the limit may result in additional fees.

Do these banks offer investment or retirement accounts? Yes, many of these banks offer investment options, including brokerage services and retirement accounts like IRAs.

What is the process for applying for a loan with these banks? The loan application process varies depending on the type of loan you are seeking. Contact the bank or visit their website to learn about their loan offerings and application process.

Can I transfer money internationally through these banks? Yes, many of these banks offer international wire transfer services. However, fees and processing times may vary.

Are there any discounts for students or seniors? Some banks offer special account options or fee waivers for students and seniors. Check with the bank for specific benefits.

How often are interest rates updated for savings accounts? Interest rates for savings accounts are subject to change based on market conditions and Federal Reserve decisions.

Can I access customer service 24/7? Some banks offer 24/7 customer service through phone or online chat, ensuring assistance is available whenever you need it.